Our Office of Audit conducts audits and other engagements of programs and operations across the agencies we oversee in accordance with various statutory standards and authorities. Our products typically result in recommendations to improve the effectiveness, economy, efficiency, internal control, and compliance with requirements of foreign assistance programs.

Our Approach to Auditing

We audit the efficiency and effectiveness of U.S. foreign assistance programs and operations, which can include their internal controls and compliance with laws, regulations, and agency guidance. Some of our work is mandated by statute or based on requests from key stakeholders including Congress. Other work is performed at OIG’s discretion following a risk-based planning process. In keeping with our oversight mandates, we help ensure accurate and transparent financial reporting, the security of information technology assets, and the proper use of travel and purchase cards. We verify that agencies are doing the accounting that is required and upholding the accountability principles that guide all Federal agencies.

When identifying and prioritizing discretionary audit work, we consider many factors:

- OIG’s strategic goals and agencies’ top management challenges.

- Stakeholders’ needs and requests, gathered through outreach with agency officials, congressional committees, board members, and others, as well as within OIG.

- The source and amount of funds going to key programs, countries, regions, and implementers.

- Risks associated with the agencies’ programs, including potential vulnerabilities in internal controls.

- Results of prior audit and investigative work.

- Our determination of program areas and operations where we could have the biggest impact.

Types of Engagements

Performance Audits

Performance audits provide information to improve program operations, facilitate decision making by parties with responsibility to oversee or initiate corrective action, and contribute to public accountability. Performance audits are performed in accordance with Generally Accepted Government Auditing Standards and cover a wide range of topics based on specific requests from congressional committees and members, OIG’s strategic goals and the top management challenges facing the agencies we oversee, and other factors.

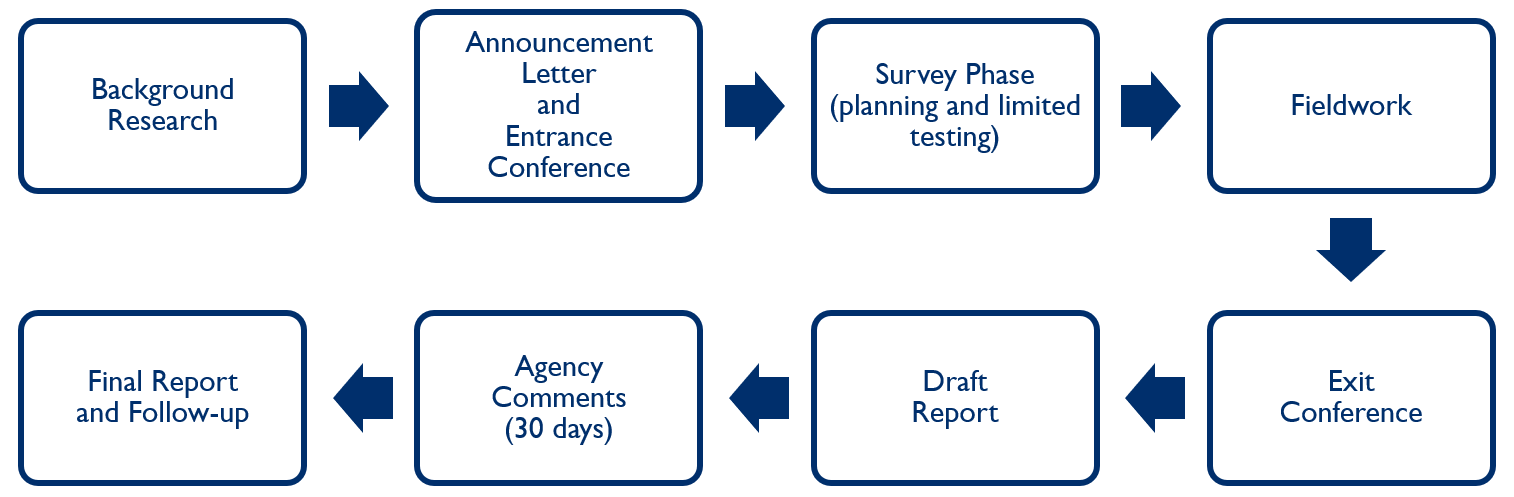

Performance Audit Process

Attestations and Assessments

We perform attestations and assessments that are more limited in scope than an audit. Attestations include examinations, reviews, and agreed-upon procedures reports that are conducted in accordance with applicable standards. Assessments systematically identify and evaluate risks that could facilitate or impede the achievement of particular objectives and are conducted in accordance with internal policies and procedures.

Oversight of Financial, Information Technology, and Non-Federal Audits

We oversee mandated audits, such as financial statement and information security audits that are performed by contracted independent public accounting firms. These audits help ensure accurate and transparent financial reporting, the security of information technology assets, and the proper use of travel and purchase cards.

Typically, OIG is also responsible for determining whether audits of grantees and contractors obtained by USAID and MCC meet professional standards for reporting and other applicable laws, regulations, or requirements. We fulfill this responsibility by performing desk reviews of the audit reports and issuing non-Federal audit (NFA) transmittal memos, which may include recommendations to the agency. At times, we also conduct quality control reviews of the workpapers supporting these audit reports. Learn more in the NFA Primer.